Customer Services

Copyright © 2025 Desertcart Holdings Limited

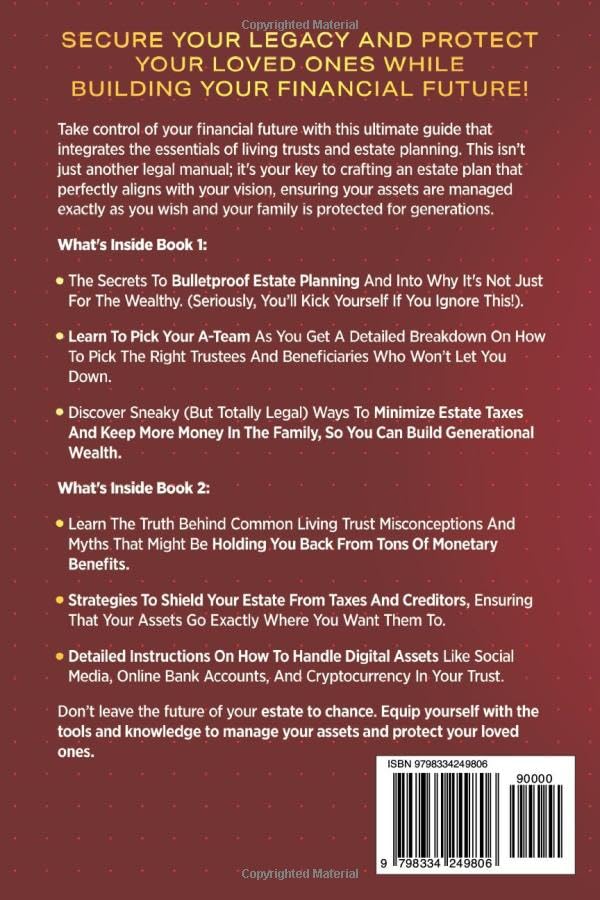

Estate Planning & Living Trusts - The Ultimate Guide (2 In 1): How To Protect Your Assets, Lower Tax Liability, & Set Your Family Up For Generations + Avoid Probate (Wealth Strategy)

C**M

Valuable and accessible information made easy by the authors style

The authors offer two books in one, in estate planning and living trusts, which mutually reenforce each other. They also offer education in these intimidating areas in a clear almost outline form so the reader can easily identify topics for each paragraph and determine what to focus on. At a higher level, one of the many quotes stands out as a theme for this book “Education is the premise of progress, in every society, in every family.” This book educates, not only for the reader but for the reader’s protection of his or her family and protecting the assets built for that family. The advice goes beyond the actual instruments, legal, business and tax guidance to recommending strategies to work with the professionals required. From the subject to inspiration to undertake these instruments, this is an excellent source of information.

P**R

A comprehensive guide to estate planning

This guide is a detailed and practical resource for anyone looking to protect their assets and plan for the future. I appreciated the clear explanations of complex topics, like the differences between revocable and irrevocable trusts and how to handle digital assets within a trust. The tips on avoiding probate and minimizing taxes are particularly useful, making the process feel more approachable. The included checklists and workbooks add extra value, helping you organize and implement your plans step-by-step. It's a solid guide for anyone wanting to take control of their estate planning and set their family up for success.

B**5

Learn how to protect your assets

When most people think about estate planning, the general first reaction is: This is not for me. In fact, estate planning is something that generally pertains to the rich and famous people. However, the author does a great job explaining that the mentality of those who believe estate planning is only for the rich is wrong and can be costly. If people do not realize the importance of estate planning early enough, they might face difficult problems later on in the future and not be able to properly manage their assets. For this reason, the book does a good job of offering a nice education so that everyone, especially skeptical people, can understand the value of estate planning. I like that the book also recognizes that the strategies for estate planning are not fixed, but need to be constantly adjusted as life changes, new priorities come, disasters occur, and unexpected challenges manifest. Planning becomes even more important when there are unknown events that could shake our lives, and we need to be prepared so that our assets can maintain, or even increase, their value. Great book!

V**U

Thorough

Explained in an easily understood way. It's a great asset for estate planning.

K**H

Get ahead and learn the basics

I wanted to get ahead and learn the basics before diving deep and involve getting lawyers to help me take care of my family's assets. Just like planning for your life and getting health insurance, another way to secure your future is protecting your assets. This book provided basics of estate planning, understand key definitions, and navigate taxes and legalities. It also provided points to consider in choosing the right lawyer to help me. Bonus on this book is the checklist, I like to track my progress and to dos.

L**S

Estate planning that you can do inexpensively

Estate Planning & Living Trusts—The Ultimate Guide (2 In 1): How to Protect Your Assets will be the most important self-help book in your library. You will learn how to prepare your estate so your heirs do not need to go through probate. You will bulletproof what you are leaving to your loved ones. It's a book worth its weight in gold. This is highly recommended.

C**A

Informative .

Concise and informative. A must read for anyone in the planning stages of a will or a trust.

L**Z

An excellent resource to begin estate planning.

This book provides valuable information to help you start estate planning.

J**E

Leave a well-managed, protected legacy

This book is a comprehensive, user-friendly guide that takes the complexity out of living trusts and estate planning, making it accessible for everyone, regardless of prior knowledge. This book’s clear and practical approach is perfect for anyone looking to protect their assets, minimize taxes, and secure a legacy for their loved ones without getting bogged down by legal jargon. Covering everything from digital assets to strategies for blended families, this book goes beyond the basics, offering nuanced solutions that reflect real-life family dynamics and needs.

R**A

Easy Estate Planning

This isn’t just another boring legal book; it actually gives practical advice that speaks directly to my situation. I've learned so much about living trusts—who knew they could protect my assets from taxes and creditors? The author does an excellent job of dispelling common myths that had been holding me back for ages.

A**L

Una guía muy útil para todo el mundo

El libro es un conjunto de consejos financieros, de gestión de patrimonio e inversión. Me gusta su lenguaje claro y accesible, que hace que cualquier persona con educación financiera básica pueda obtener estrategias para gestionar sus bienes de una forma profesional y rentable. Creo que tendría que haber mas libros como este. ¡Gran trabajo!

E**A

Well written guide!!

Nice guide with detailed instructions on how to handle assets, strategies to provide for dependents, to shield estate from creditors, and more... Very useful guide! Recommended

E**K

Perfect bundle!

This bundle offers an extensive guide to estate planning and living trusts, providing strategies to circumvent probate, safeguard heirs, and reduce legal complications. It addresses subjects include fortifying estate planning, collaborating with an appropriate attorney, managing intricate family dynamics, traversing probate, and reducing estate taxes.The book addresses the essential principles of living trusts, delineating the distinctions between revocable and irrevocable trusts, as well as techniques to protect your estate from taxation and creditors. It additionally addresses the management of digital assets and provisions for children and dependents. Estate planning is essential for all individuals, not solely the affluent, as it safeguards the welfare of beneficiaries while navigating the intricacies of legal and financial implications. The book serves as an essential resource for individuals seeking to safeguard their possessions and strategize for the future.

Trustpilot

2 months ago

1 month ago